Market Summary

| Index | Value | Change | Percentage |

|---|---|---|---|

| Dow | 31,097.26 | -253.88 | 1.05 |

| S&P 500 | 3,825.33 | -33.45 | 1.06 |

| Nasdaq | 11,127.85 | -149.16 | 0.90 |

| Russel 2K | 1,727.76 | 19.77 | 1.16 |

| VIX | 26.70 | -2.01 | 7.00 |

There is a saying - all well those ends well. We see that in the market today. In a highly volatile market, with swings of almost 600 points in Dow. At the end all indices end up higher almost one percent. VIX dropped below 28 with 7 percent decline, which indicates general FUD in market is stabilizing.

A Federal Reserve tracker of economic growth is pointing to an increased chance that the U.S. economy has entered a recession. As assumed by most, the recession could be here, sooner than most assumed when it would arrive. Nerve wrecking to say the least. We have had such a bad six months, to start the next half of the year, we get this discouraging news feels pretty bad I must admit.

TSLA stocks continue to show weakness. Second quarter delivery numbers are scheduled to be released on 7/2/2022. Musk has been quite on his market destructive tweets. I am a die hard fan of Tesla, but I wish Elon was not the CEO of that company. He causes so much turbulence on the stock prices with his silly tweets that it is hard to stay invested in Tesla.

Update on 7/2/2022 : Tesla delivery numbers are out for quarter 2. Highlights are below -

- A year ago, Elon Musk’s electric car business delivered 201,250 vehicles in the second quarter.

- Tesla was hamstrung during the period ending June 30, 2022, by parts shortages, supply chain snarls and Covid restrictions that forced China’s Shanghai factory to close or operate only partially for weeks.

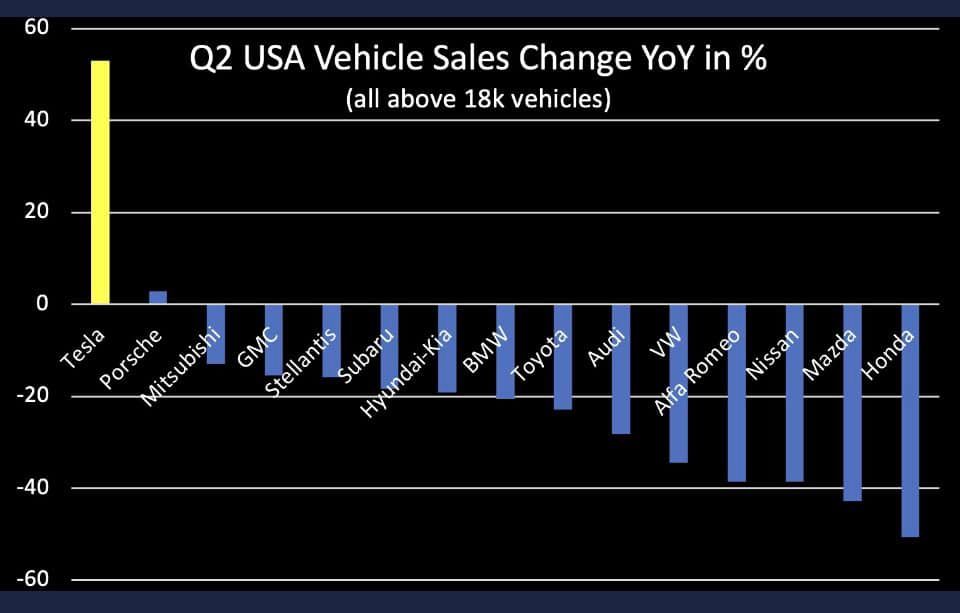

The chart below demonstrates Tesla’s delivery numbers compared to other auto manufacturers.

Strategy

- Be prepared for recession that is now in my opinion inevitable.

- Timing the market is nearly impossible!

News

- S&P 500 posts worst first half since 1970, Nasdaq falls more than 1% to end the quarter

- GM, Ford rising, Tesla falling in EV ‘car wars’ in U.S., Bank of America analyst says

- Fed’s preferred inflation measure rose 4.7% in May, around multi-decade highs

- The market’s worst first half in 50 years has all come down to one thing

- Tesla delivered 254,695 electric vehicles in the second quarter of 2022